PH BIR 1905 2021-2026 free printable template

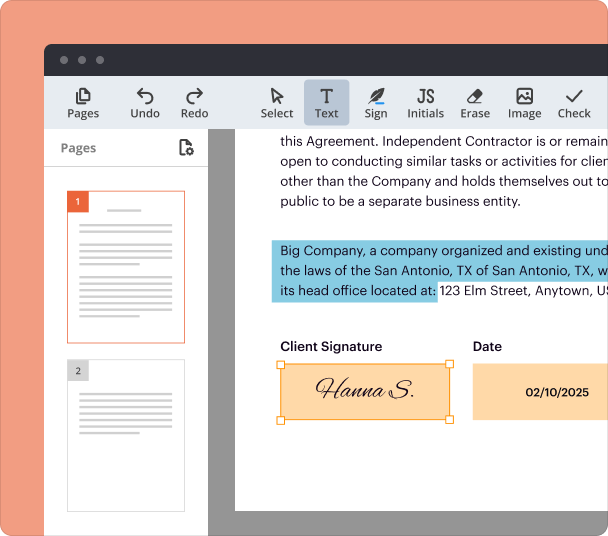

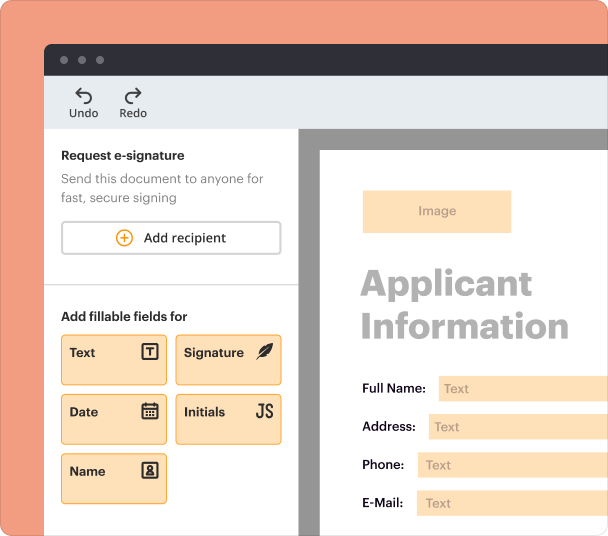

Fill out, sign, and share forms from a single PDF platform

Edit and sign in one place

Create professional forms

Simplify data collection

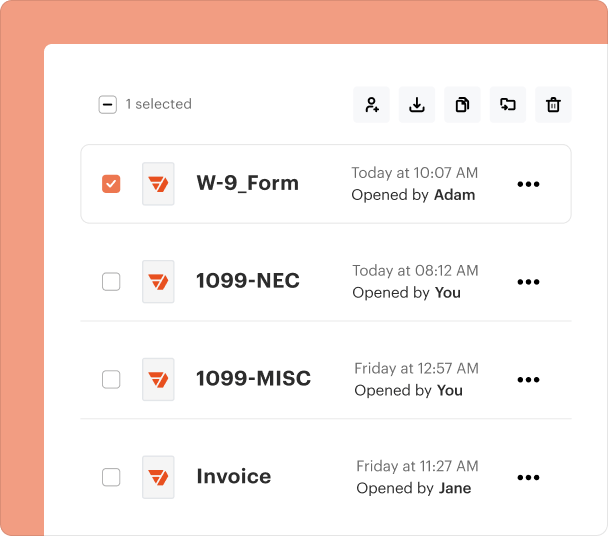

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

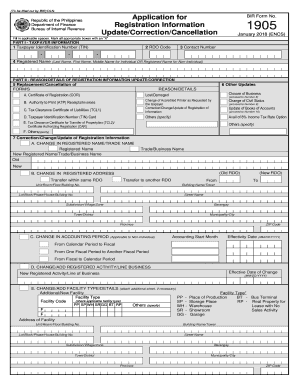

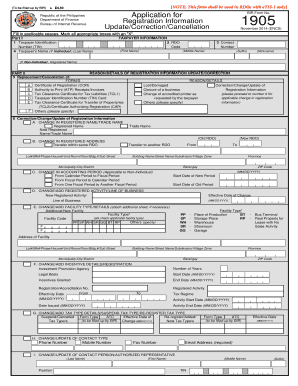

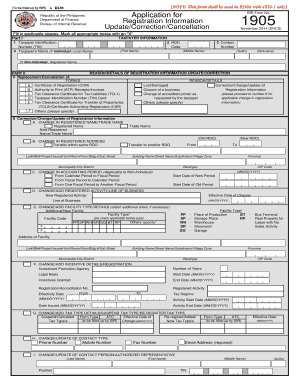

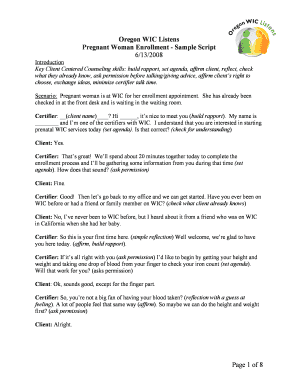

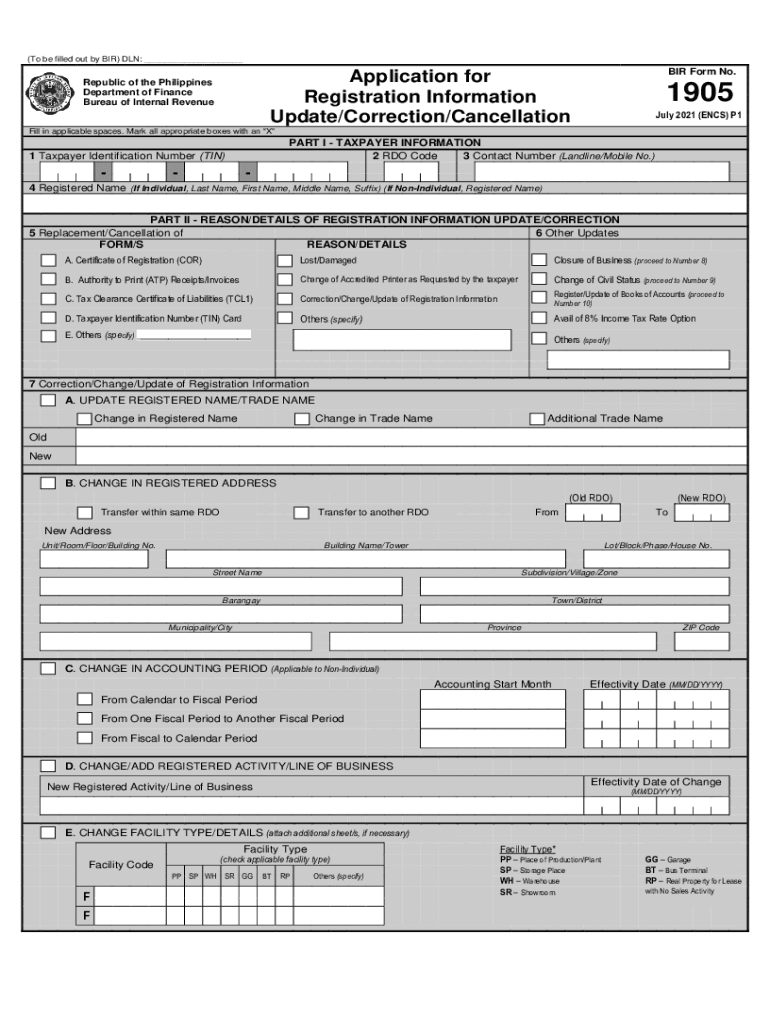

Understanding the PH BIR 1905 Form for 2

What is the PH BIR 1905 Form?

The PH BIR 1905 form is a document issued by the Bureau of Internal Revenue (BIR) in the Philippines, designed for taxpayers to update their registration information. This includes corrections, additions, or cancellations of previously submitted details. The current version is applicable for use from 2021 to 2025, reflecting changes in the taxpayer's information that may arise due to business updates or changes in personal circumstances.

When to Use the PH BIR 1905 Form

This form should be used whenever there is a need to amend any taxpayer registration information. Common situations include moving to a new address, changing an accounting period, or updating registered activities and business names. It’s essential to use this form in a timely manner to ensure compliance with tax regulations and avoid penalties.

Who Needs the PH BIR 1905 Form?

Every individual or entity registered in the Philippines and required to maintain updated records with the BIR must utilize the PH BIR 1905 form. This includes sole proprietors, corporations, partnerships, and any business entities that need to report changes to their taxpayer identification information.

Required Documents and Information

To complete the PH BIR 1905 form, taxpayers must provide specific information, including their Taxpayer Identification Number (TIN), registered name, contact details, and details about the changes being requested. Supporting documents may include proof of business address, amendments of Articles of Incorporation, or other legal documents that validate the submitted changes.

How to Fill the PH BIR 1905 Form

Filling out the PH BIR 1905 form requires careful attention to detail. Taxpayers should start by clearly entering their TIN, registered name, and other requested information in the appropriate fields. Make sure to mark all applicable boxes to indicate the nature of the changes. It is also crucial to double-check all entries for accuracy to prevent any processing delays.

Best Practices for Accurate Completion

To ensure the proper submission of the PH BIR 1905 form, consider the following best practices: review all instructions carefully, keep records of any submitted documents, and verify the accuracy of your entries. It is advisable to consult with a professional tax advisor if there are uncertainties regarding the form's requirements or implications.

Frequently Asked Questions about 1905 bir form

What is the purpose of the PH BIR 1905 form?

The purpose of the PH BIR 1905 form is to allow taxpayers to update their registration information with the Bureau of Internal Revenue in the Philippines.

Who should fill out the PH BIR 1905 form?

Any registered taxpayer in the Philippines, including individuals and entities that need to amend their registration details, should fill out the PH BIR 1905 form.

What information is required to fill out the PH BIR 1905 form?

Required information includes the Taxpayer Identification Number (TIN), registered name, contact details, and details of the changes being requested.

pdfFiller scores top ratings on review platforms